paying indiana state taxes late

BBB Accredited A Ratings. A Rated in BBB.

Indiana Department of Revenue.

. Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. For those collecting less than. - As Heard on CNN.

Ad We Can Solve Any Tax Problem. 10 of the unpaid tax liability or 5 whichever is greaterThis penalty is also imposed on payments which are required to be remitted electronically but are. Ad BBB A Rating.

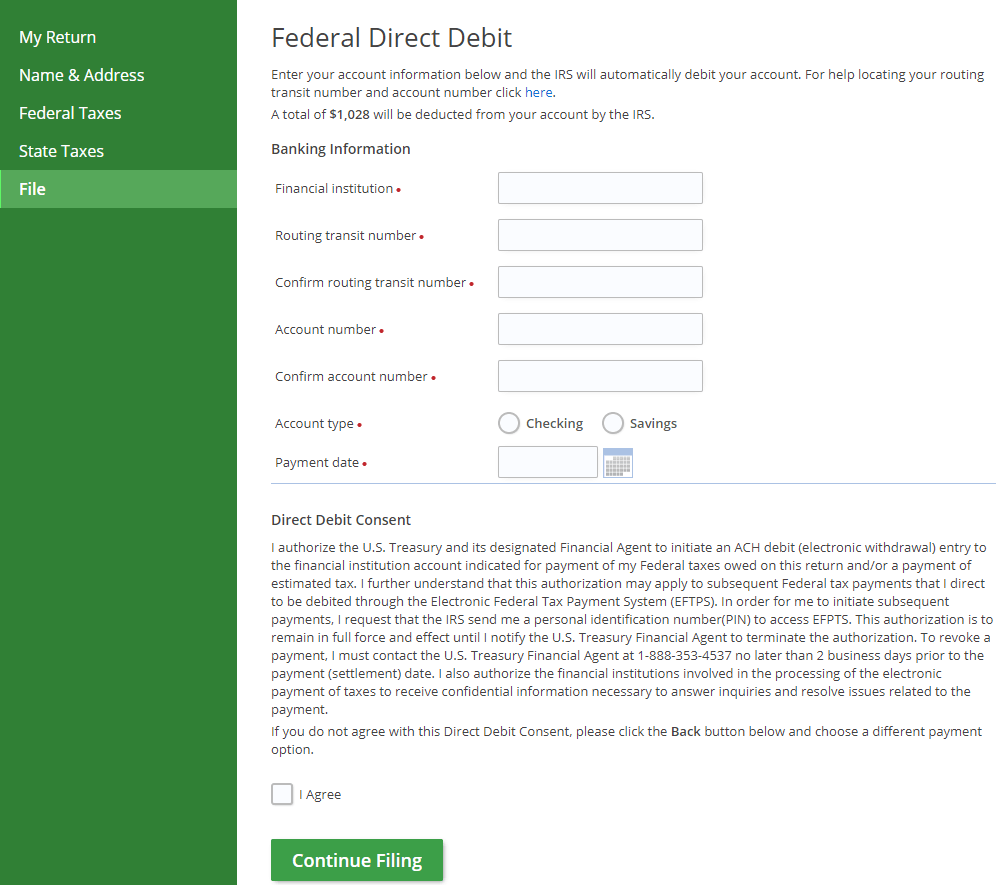

- As Heard on CNN. What is the penalty for paying Indiana state taxes late. Indiana does not do a direct debit for taxes due from.

5 Best Tax Relief Companies of 2022. End Your Tax Nightmare Now. Including local taxes the indiana use tax can be as high as 0000.

Solve All Your IRS Tax Problems. The discount varies depending on the size of what was collected. Tax Penalties Failure to pay tax 10 of the unpaid tax liability or 5 whichever is greater.

This penalty is also. 1 Best answer. If You Owe Taxes Get A Free Consultation for IRS Tax Relief.

For those who meet their sales tax compliance deadlines Indiana will offer a discount as well. Ad Let Us Find You The Best Tax Relief Company In Your Area Get Help With Back Taxes. The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME.

By law the IRS may assess penalties to taxpayers for both. What is Indiana state tax. Trusted Tax Resolution Professionals to Handle Your Case.

Defend End Tax Problems. 9 hours agoSeptember 27 2022 1033 AM. List of Companies Trusted by 1000s.

Resolve your tax issues permanently. Failure to pay tax 10 of the unpaid tax liability or 5 whichever is greater. The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan.

DORpay remains available to make single payments on tax bills due for the following tax types until July 8 2022. Affordable Reliable Services. Ad BBB Accredited A Rating.

Last month the Hoosier State. Take Avantage of Fresh Start Options Available. April 15 is the annual deadline for most people to file their federal income tax return and pay any taxes they owe.

I ndiana residents could soon receive payments totaling up to 325 for individual filers and 650 for joint filers. 100s of Top Rated Local Professionals Waiting to Help You Today. In 2017 that rate fell to 323 and has remained there for the 2019 tax year.

Solve All Your IRS Tax Problems. Ad BBB A Rating. You may request a filing extension but this does not push back the payment due date.

Ad Dont Face the IRS Alone. Get Your Tax Options for Free. TurboTax cant send it because Indiana does not allow it.

Get free competing quotes from the best. Tax Relief up to 96 See if You Qualify For Free. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility.

What is the penalty for paying Indiana state taxes late. Ad We End IRS State Tax Issues. What happens if you pay Indiana state taxes late.

End Your IRS Tax Problems - Free. Failure to pay tax. Overview of Indiana Taxes Indiana has a flat statewide income tax.

This penalty is also. May 17 2021 334 PM.

State Stimulus Payments 2022 These States Are Sending Out Money In September Cnet

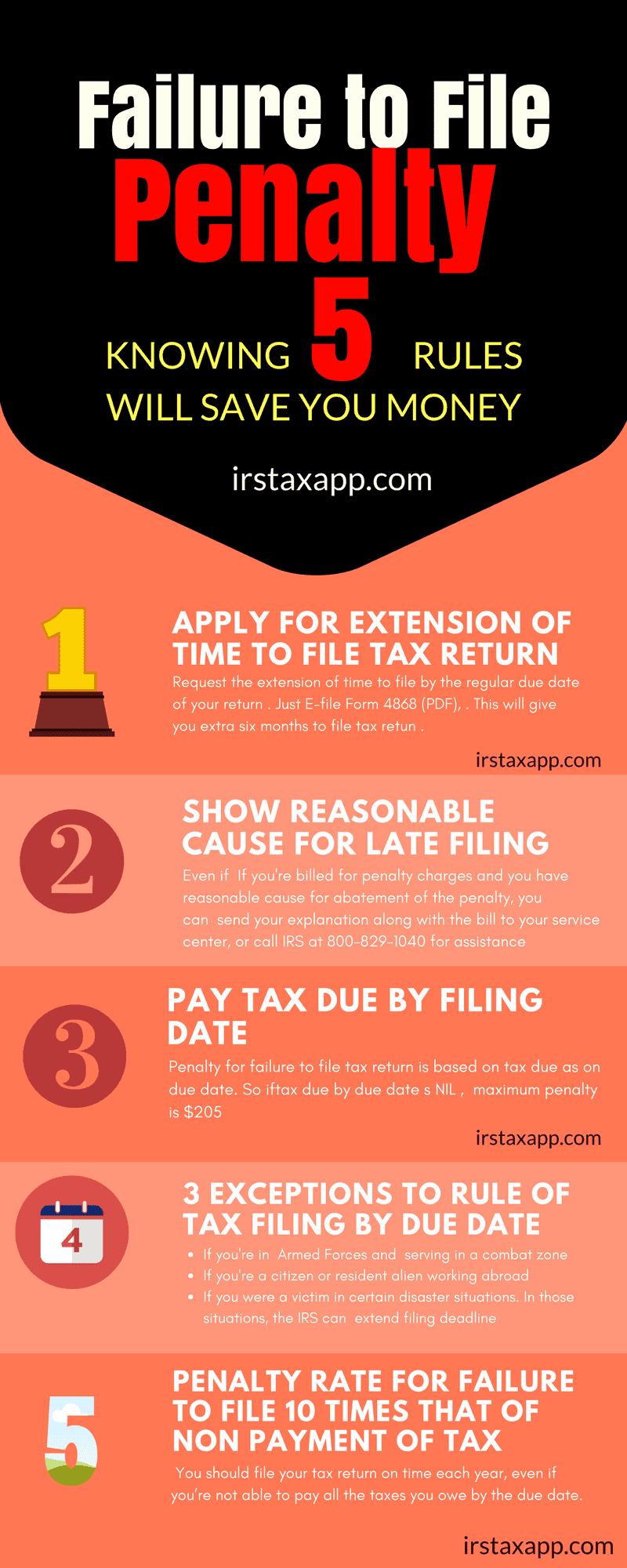

Penalty For Filing Taxes Late How To Prevent Internal Revenue Code Simplified

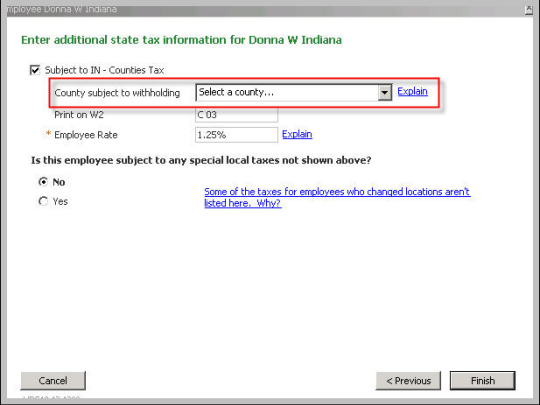

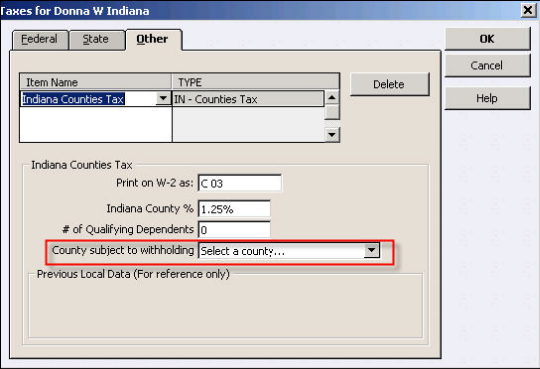

Quickbooks Payroll Indiana Counties Tax Filing Enhancement

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Late Filing And Late Payment Penalties Ils

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Quickbooks Payroll Indiana Counties Tax Filing Enhancement

Indiana Sales Tax Small Business Guide Truic

Irs Tax Refunds Coming If You Paid Late Tax Filing Penalties Money

What Are The Penalties For Not Paying Sales Tax Taxvalet

Irs Penalty For Late Filing H R Block

Indiana Sales Tax Information Sales Tax Rates And Deadlines

How We Got Here From There A Chronology Of Indiana Property Tax Laws

Indiana Income Tax Calculator Smartasset

Tax Deadline Extension What Is And Isn T Extended Smartasset

State Taxes For Us Expats What You Need To Know Bright Tax